Summer is almost over, but the landscaping and property maintenance industry is hot year-round — and so are opportunities for private market dealmakers.

Even in the cold months, demand for landscaping services is steady. Properties across the residential, commercial, and recreation & infrastructure sectors require maintenance, including winterizing, tree trimming, snow removal, holiday light installation, and indoor garden care.

Surprisingly, landscaping businesses are quite resilient amid turbulent economic conditions, drawing the attention of middle market dealmakers. During the COVID-19 pandemic, for example, landscaping and property maintenance companies continued to generate steady returns.

In this PE Playbook, the Grata team has put together the need-to-know trends for investors considering making moves in the landscaping and property maintenance market, including:

- How the industry is fragmented

- Where dealmakers can find dense concentrations of acquisition opportunities

- Which sector is growing the fastest

The market map above is not intended to be an exhaustive representation of companies in the space.

Companies that provide services that fall into multiple segments are categorized in this report by their primary offering.

Key Insights into the Landscaping & Property Maintenance Industry

- M&A activity in the landscaping & property maintenance industry has trended up over the course of the last 10 years. Apax Partners tops the list of most active financial sponsors in the space while FirstService Corp is the most active strategic acquirer.

- Private companies operating in the commercial sector are seeing the most expansion, with an average growth rate of 14.1% year-over-year.

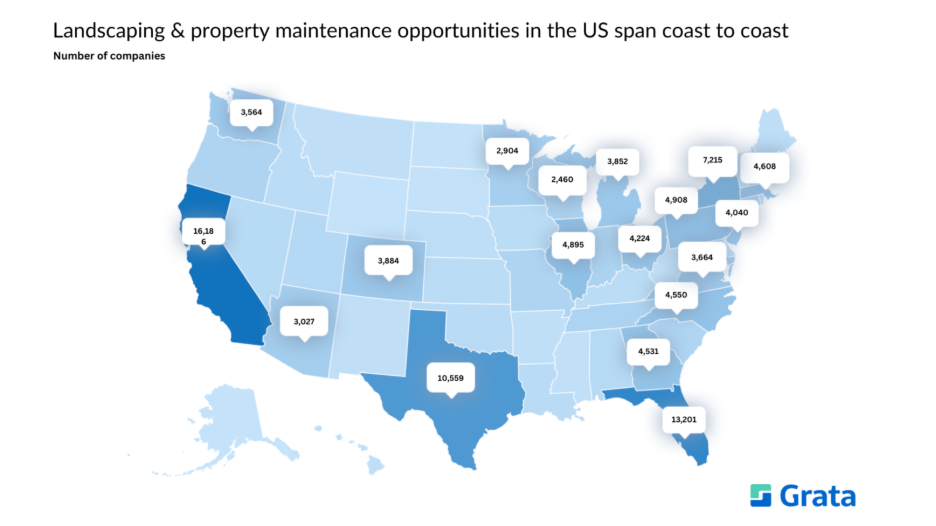

- In the US, dense pockets of opportunity are concentrated in the Northeast, Southeast, and Midwest regions.

M&A Trends in the Landscaping & Property Maintenance Industry

Transactions

Source: Grata

Landscaping and property maintenance is a massive market. In 2025, the US market alone is valued at $184B, and it’s projected to keep growing at 7.3% per year through 2030. Among the factors contributing to industry growth are:

- Rising investment in home improvement, including building attractive outdoor spaces

- Businesses investing in enhancing their properties to attract customers and new employees

- Growing demand for sustainable landscaping practices

- An influx of new tech tools in the market, such as water-saving tech and smart irrigation systems

Private market dealmakers want in on the opportunity. M&A activity — especially strategic acquisitions — has steadily trended up over the course of the last decade.

Most Active Sponsors

Source: Grata

Apax Partners tops the list of most active financial sponsors in the landscaping and property maintenance industry with 89 acquisitions. Tree services companies account for a significant portion of Apax’s acquisitions in the space.

Most Active Strategic Acquirers

Source: Grata

FirstService Corp is the most active strategic acquirer in the industry. Its acquisitions include roofing companies, fire protection services, and full-service community management businesses.

Landscaping & Property Maintenance Industry Overview

Market Distribution

Geography

Source: Grata

A main draw of the landscaping & property maintenance industry is its geographical versatility. There are opportunities just about everywhere.

The US leads the global market by number of landscaping and property maintenance companies.

Source: Grata

Within the US, each state has a concentration of landscaping businesses, regardless of their climate or topography.

That said, investors looking to make deals in the space should consider prioritizing businesses in states with extreme weather conditions and seasonal swings, as properties in those regions require more maintenance and specialized plants. That’s a big reason why some of the densest pockets of landscaping and property maintenance are located in the Northeast and northern Midwest regions of the country.

Dealmakers should also look to the Southeast, where strong population growth — particularly in suburban areas — is driving demand for residential and commercial landscaping services.

Ownership

Source: Grata

Privately owned businesses and their subsidiaries account for 70% of the landscaping and property maintenance industry. Currently, there are over 94,000 independent companies in the space that are ripe for acquisition.

Segment Distribution

Source: Grata

This report focuses on the following segments of the landscaping & property maintenance industry. Grata users can see curated lists of some of the companies used to create each segment by clicking the links below.

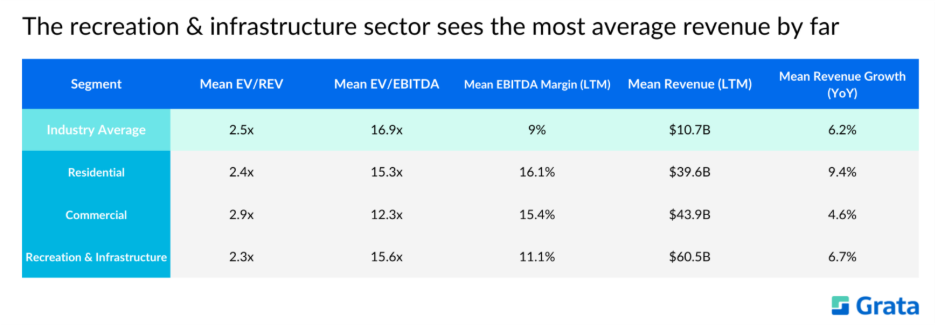

Landscaping & Property Maintenance Public Comparables

Source: Grata

In the public sphere, companies providing recreation and infrastructure landscaping & property maintenance see the most revenue on average. This is due to the confluence of growing urbanization, extensive infrastructure projects, and rising demand for sustainable practices.

Meanwhile, the residential sector sees the most growth year-over-year. Some of the key contributors to the growth are:

- Hardscaping: Homeowners are investing more in features like patios, walkways, and fireplaces using strong, natural stone. Hardscaping is one of the fastest-growing trends in residential landscaping, according to a report from Livingston Farm.

- Outdoor spaces: Homeowners are also expanding their living spaces outdoors with multi-purpose sheds, outside kitchens, and seating areas. These kinds of outdoor structures can bump property values up by 5-10%.

- Again, sustainable practices: Eco-friendly landscaping is becoming the new norm. Industry experts are observing a surge in demand for drought-tolerant plants and permeable pavers, as well as stone mulch instead of traditional bark. Rain gardens and gravel swales are also gaining popularity for managing stormwater runoff.

Landscaping & Property Maintenance Private Comparables

Source: Grata

In the private realm, the commercial landscaping & property maintenance sector is the top performer in terms of revenue and growth. Even though the growth rate for commercial construction has slowed compared to last year, spending on commercial construction projects is still expected to increase by around 5.5% in 2025. That’s spilling over into demand for commercial landscaping and property maintenance.

Businesses are also investing in their properties’ curb appeal to attract new customers and boost employee retention. Many of the factors contributing to the growth of the residential sector are also impacting the commercial world:

- Xeriscaping: This is the practice of landscaping in ways that prioritize water conservation. That means using drought-resistant plants, mulch, and more to dramatically reduce the need for irrigation.

- Sustainability tech: Smart irrigation systems are gaining traction as businesses look to lower their water use and costs. Using an automated system can conserve water and reduce the cost of manual labor. These systems can also help prevent overwatering, which improves plant health.

- Outdoor spaces: Companies are increasingly looking to integrate nature into their workspaces, especially in suburban areas. Studies show that outdoor work areas improve productivity and employee satisfaction, which can ultimately lead to higher employee retention.

Notable Acquisitions in the Landscaping & Property Maintenance Industry

Source: Grata

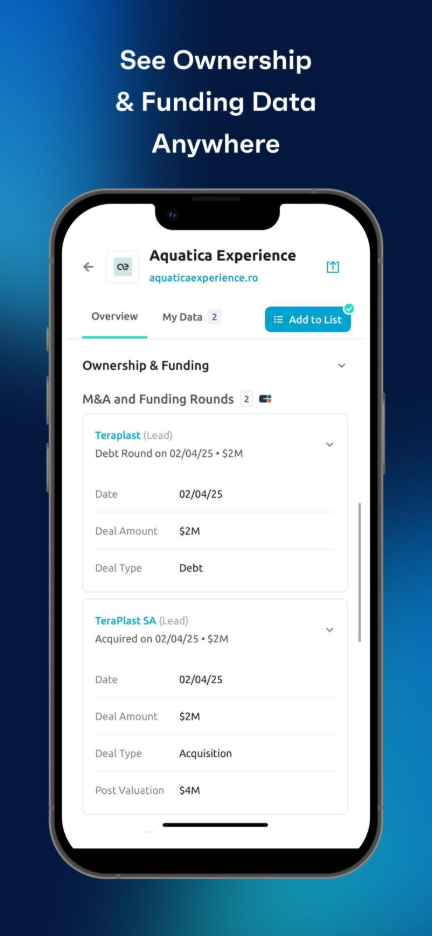

TeraPlast SA Acquires Aquatica Experience

In February, Romania-based construction materials company TeraPlast SA announced its acquisition of a 51% stake in Aquatica Experience. Aquatica is a water management company focused on providing sustainable solutions in alignment with Europe’s increasingly strict water quality standards. The deal was valued at $2.1M.

If you’re an investor interested in companies similar to Aquatica Experience, try these:

Learn more about this acquisition — or any of the others listed below — anytime, anywhere using the latest version of the Grata Go mobile app. Get all the ownership and investment data you need right in the palm of your hand.

Kingsway Financial Services Purchases Bud’s Plumbing

Kingsway Financial Services, a holding company focused on property and casualty insurance, announced its acquisition of Indiana-based Bud’s Plumbing in March. Bud’s Plumbing was established in 1920 and today services clients in the residential and commercial sector. The company was valued at $5M at the time of the deal.

If you’re an investor interested in companies similar to Bud’s Plumbing, try these:

Southern Cross Electrical Engineering Buys Forcefire

Australia-based Southern Cross Electrical Engineering announced in late March that it had acquired fire safety solutions provider Forcefire. The company focuses on the commercial and industrial sectors. It was valued at $33.5M at the time of the acquisition.

If you’re an investor interested in companies similar to Forcefire, try these:

Belvilla Acquires MadeComfy

Belvilla, a vacation rental company based in Europe, purchased MadeComfy in May. MadeComfy provides property management services for short-term rentals in Australia. The deal allows Belvilla to expand its geographical footprint into the Australian and New Zealand markets.

If you’re an investor interested in companies similar to MadeComfy, try these:

Tribe Property Technologies Purchases Ace Agencies

Also in May, Tribe Property Technologies announced its intention to buy Ace Agencies, a property management company based in Abbotsford, British Columbia. The move strengthens Tribe’s presence in the residential sector, specifically in single-unit rentals.

If you’re an investor interested in companies similar to Ace Agencies, try these:

Sterling Infrastructure Buys CEC

Sterling Infrastructure announced in June that it had entered into a definitive agreement to acquire CEC, a Texas-based facilities management company. CEC offers a wide range of services, including janitorial services, building maintenance, landscaping, and general facility management. Its typical customers are commercial property owners.

If you’re an investor interested in companies similar to CEC, try these:

Live Landscaping & Property Maintenance Deals

Hundreds of live deals and active mandates are being showcased on the Grata Deal Network. Here are some examples of mandates related to the landscaping & property maintenance industry. Grata clients can view the deals directly in the Grata Deal Network by clicking the links below:

- A Florida-based landscaping and tree business with $6.5M in revenue and a $5.1M expected valuation

- A landscaping and agricultural equipment solutions company that sees $3.4M in revenue and has a $1.1M expected valuation

- A commercial landscaping and irrigation business based in Florida with $5.8M in revenue and a 7.7% EBITDA margin

If you’re interested in these deals and you want to see more, register here to learn more.

Are you a sell-side advisor interested in generating inbound leads for your data center infrastructure deal? Get started here.

Landscaping & Property Maintenance Conferences

Grata makes it easy for dealmakers to find conferences, events, and trade shows in their industries. View attendee lists so you can set up meetings beforehand and make the most of your travel time. Check out which companies attended past events to find more potential targets.

Here are a few of the events related to the landscaping & property maintenance industry that dealmakers can find and track in Grata:

Source: Grata

Get the Most Out of the Playbook

If you’re an investor interested in making moves in the landscaping & property maintenance space, Grata can help you put the insights in this article into action.

From in-depth market research and sourcing to pipeline management and relationship nurturing, Grata’s end-to-end dealmaking platform streamlines your workflows so that you can close more deals.

Schedule a demo today to get started.

.png)