AI

AI That Thinks Like an M&A Analyst

Grata’s Contextual AI doesn’t just extract data; it interprets company signals like a deal team would. That means smarter targeting, better accuracy, and faster decisions.

AI that understands companies the way you do

Reads Like an Analyst

Our AI engine reads millions of websites the way a human would — analyzing structure, navigation, language patterns, and commercial signals to understand what a company actually does.

Creates Data Where None Exists

When revenue, industry, or model data is missing, Grata’s AI uses conceptual inference and triangulation to generate verified estimates.

Builds a Consensus from Chaos

Unstructured, conflicting, or sparse data? Our contextual AI layers multiple sources and weights confidence scores to produce a clean, usable view.

Enables Smarter Search and Scoring

AI isn’t just a backend tool, it powers Similar Search, relationship scoring, pipeline updates, and more throughout the platform.

See How Grata’s AI Unlocks the Private Market.

Trusted by leading investment firms and now a core engine of Datasite’s M&A software platform.

WHY CUSTOMERS LOVE GRATA

Customer Testimonials

“Grata is most helpful for us from a prospecting perspective. We have a team of analysts and associates, and even senior folks at [firm] who spend a ton of time identifying companies that could be platforms or great add-ons for our portfolio companies. That is the most helpful aspect and where we get the most benefit from Grata.”

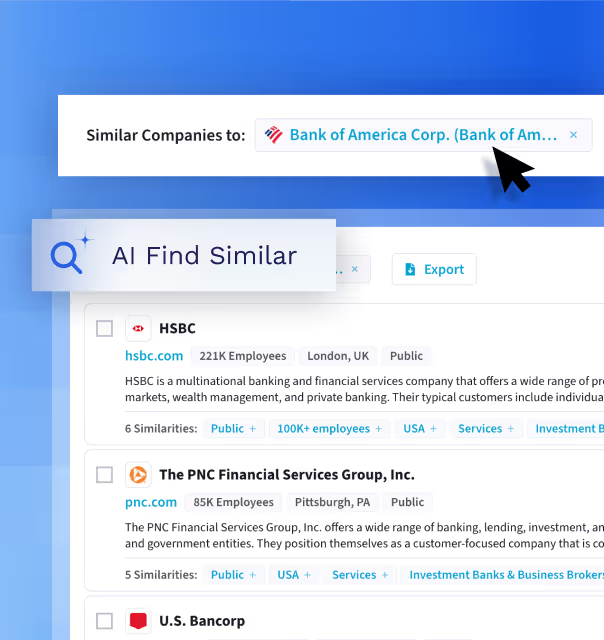

"For me, what I use Grata for the most is the AI find similar search. If we lose a bid on a company and want to go after similar companies, it's really easy to do the AI find similar and narrow down by private size range and other filters. It does a great job. That's what we primarily use it for, building lists, so it's been great for that."

AI

AI that makes every step smarter

Understand what companies do, uncover lookalikes, analyze inferred data, and prioritize targets - all powered by Grata’s contextual AI.

Define

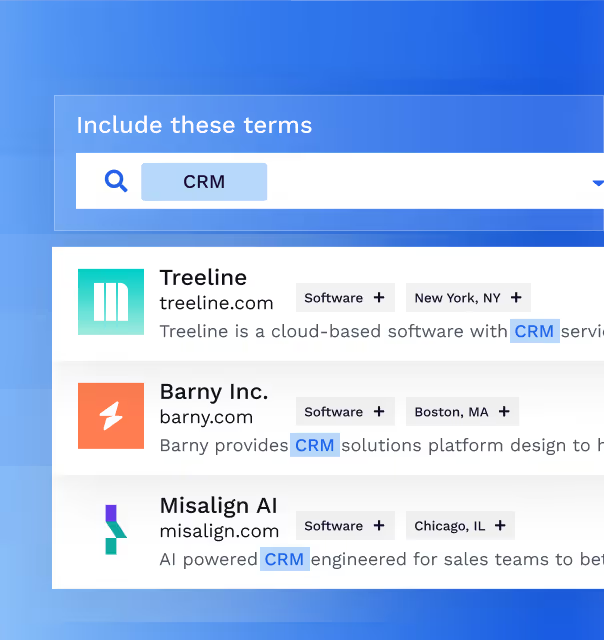

Understand exactly what a company does

Discover

Let Similar Search surface lookalike targets you didn’t know existed

Analyze

Leverage AI-generated data like estimated revenue or inferred industry

Target

Prioritize companies using AI scoring, growth indicators, and event signals

Frequently asked questions

What is an AI deal sourcing platform?

An AI deal sourcing platform uses machine learning to identify, analyze, and prioritize private companies for investment or acquisition. It replaces manual list building with intelligent discovery based on business relevance, not just static categories.

How is AI used in deal sourcing and M&A research?

AI is used to discover companies, interpret business models, surface market signals, and rank opportunities. This allows deal teams to move faster while reducing noise and missed opportunities.

How does AI identify private companies that are hard to find?

AI analyzes fragmented data across the web, proprietary datasets, and contextual relationships. By interpreting meaning rather than relying on exact matches, it can surface companies that traditional databases miss.

What are the benefits of AI-driven company classification?

AI-driven classification reflects how companies actually operate rather than how they self-label. This leads to more accurate targeting, cleaner lists, and better strategic alignment.

Can AI improve accuracy in early-stage diligence?

AI improves early diligence by standardizing data, highlighting inconsistencies, and surfacing relevant signals at scale. This reduces manual errors and speeds up initial screening.

How does Grata use AI for deal sourcing?

Grata uses contextual AI to understand companies the way an M&A analyst would. The platform identifies relevant businesses by analyzing products, customers, and market focus rather than relying on rigid taxonomies.

What makes Grata’s AI different from other AI deal sourcing platforms?

Grata’s AI is purpose-built for private markets and M&A workflows. It focuses on interpretability, precision, and relevance instead of generic keyword matching.

How does Grata AI generate company data when information is incomplete?

Grata AI combines partial disclosures, inferred signals, and proprietary data to build structured company profiles. This enables coverage even for private companies with limited public visibility.

How does Grata AI help prioritize acquisition targets?

The platform evaluates companies across multiple signals to assess strategic fit. This allows teams to quickly narrow large universes into high-confidence target lists.

Can Grata AI be trusted for sourcing and diligence workflows?

Grata AI is designed to support, not replace, analyst judgment. Its outputs are transparent and structured to fit directly into sourcing and diligence processes.