Stay Smart, Stay Early.

Grata tracks real-time changes across industries so you always have the latest information

Discover Your Next Market

Follow emerging trends

Build segment definitions from the ground up

Access curated insights without building decks from scratch

Expand Your Perspective.

Trusted by over 1,000 global customers, 35 of the top 40 firms, and 9 of the top 10 management consulting firms.

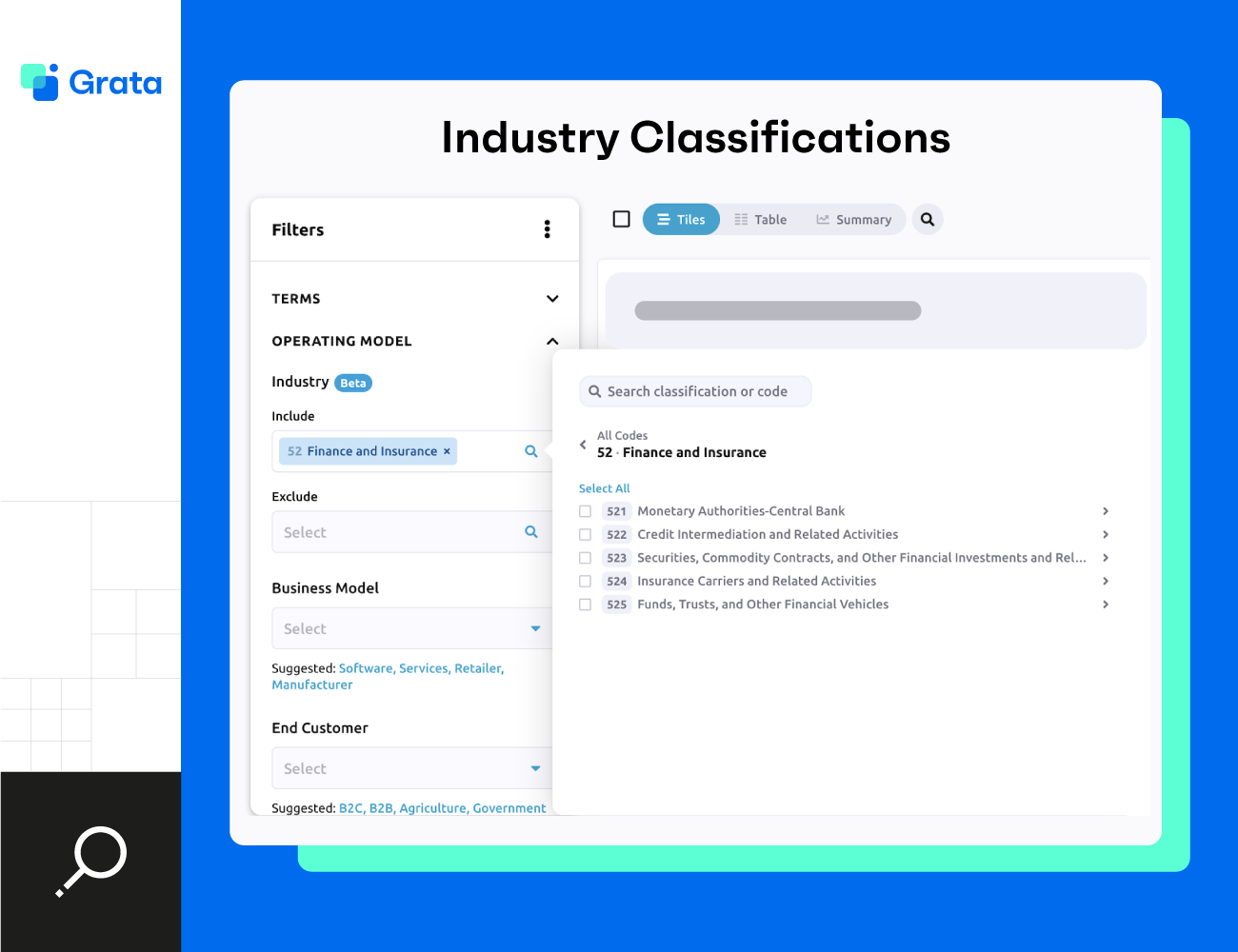

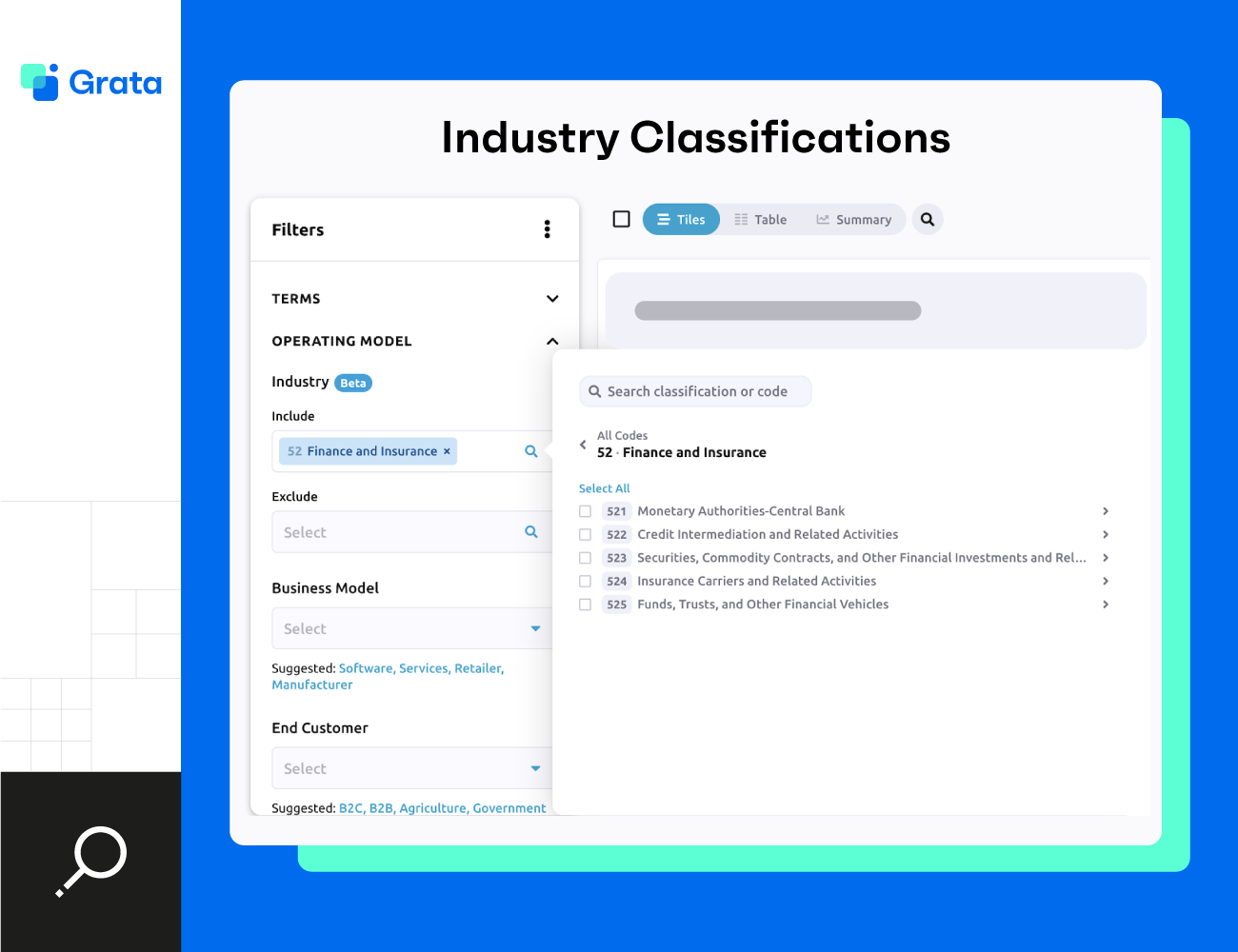

INDUSTRY RESEARCH

Dig deep with investment-grade data

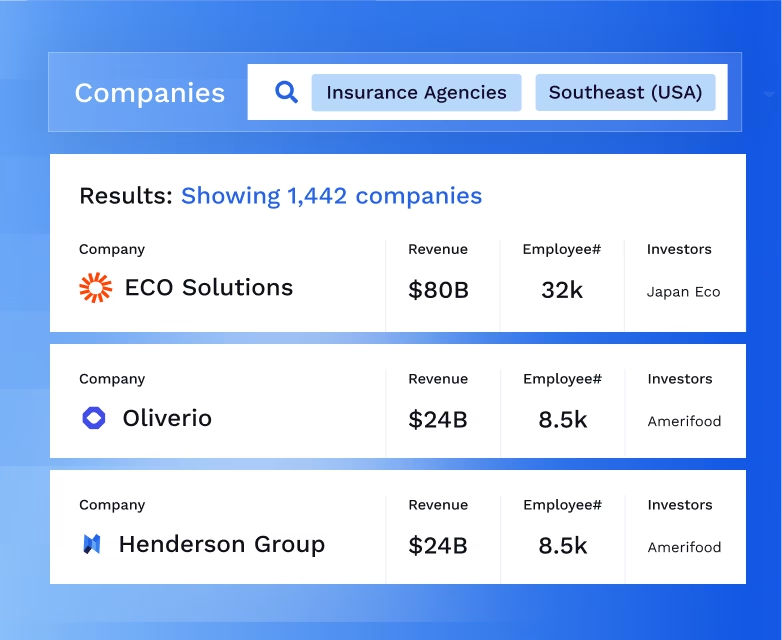

Size

Size your market. Access comprehensive company lists, private company revenue estimates, and proprietary employee counts.

Assess

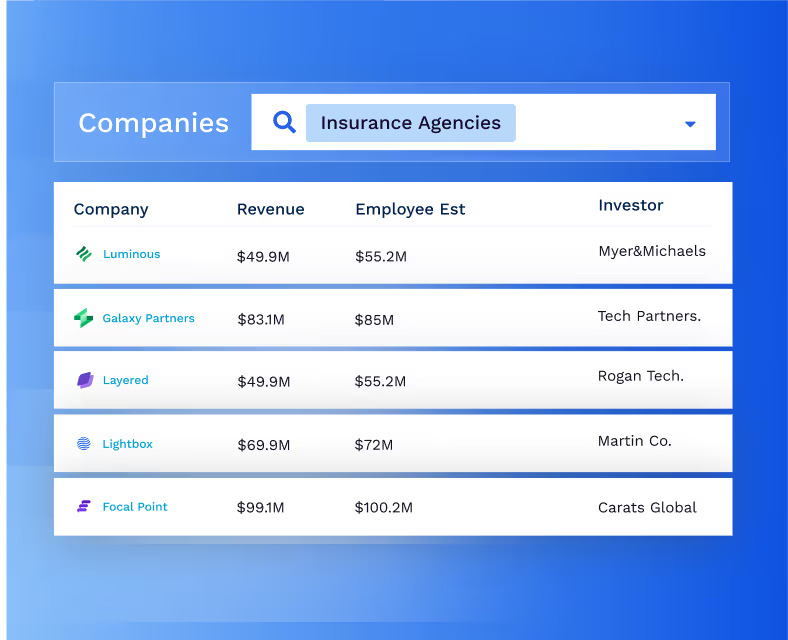

Assess competitive dynamics and M&A potential. See detailed business locations to pinpoint pockets of opportunity.

Capture

Capture hidden subsegments and market adjacencies with comprehensive tagging.

WHY CUSTOMERS LOVE GRATA

Customer Testimonials

The fact that Grata was already focusing on AI before it become a widespread trend shows they're ahead of the curve, positioning AI as the future.

For me, the biggest thing is definitely due diligence and industry comps. That's really what I go to Grata for, because the way you're able to put in a company and then break down its size and more makes it so much easier for me. From there, I can decide if it's a fit or not.

Schedule a demo to get started

From family-owned roofing companies to PE-backed enterprise software and everything in-between, Grata has the data you need.

Frequently asked questions

How do I break an industry into meaningful sub-segments?

Analysts group companies by business model, specialization, customer type, and operational attributes to reveal the true structure of a market.

How can I quickly learn who the key players are in a new industry?

Teams scan company density, growth indicators, hiring activity, and recorded signals to identify leaders, challengers, and emerging operators.

How do I analyze an industry with little public data available?

You rely on private-company attributes, like headcount, product focus, technology stack, and market activity, to understand how the industry functions.

What’s the fastest way to understand trends in a fragmented market?

You track hiring, new entrants, leadership moves, acquisitions, and technology adoption to see where the market is shifting.

How does Grata make industry research faster and more accurate?

Grata maps entire industries using private-company attributes, revealing true segments, hidden niches, and emerging patterns traditional codes miss.

Can Grata help me size an industry or segment?

Yes. Grata shows market fragmentation data, how many companies operate in a sector, geographic pockets of opportunity, and more.

How does Grata help analysts understand competitive landscapes?

Grata highlights differences in business models, capabilities, growth signals, and positioning, making it easier to compare operators within a market.

Can Grata identify emerging sub-industries before they mature?

Absolutely. Grata surfaces signals, such as hiring momentum, product launches, and concentrated new company formation, that reveal early-stage segments.

How do teams use Grata to validate industry hypotheses?

Analysts use Grata to map companies, test assumptions, compare segments, and confirm whether their thesis aligns with actual market structure.

What improvements do teams see when using Grata for industry research?

Faster ramp-up on new sectors, clearer market maps, deeper competitor insights, and more confident decision-making around sourcing and strategy.

Check Out Additional Industry Research Resources Here

Private Equity Research: Process, Tools, and Best Practices

Market Research: The Next Chapter For Grata