Build Defensible Models

Grata quickly sets the scene for your market with the most accurate public company comparables.

Understand Crucial Context for Your Deal

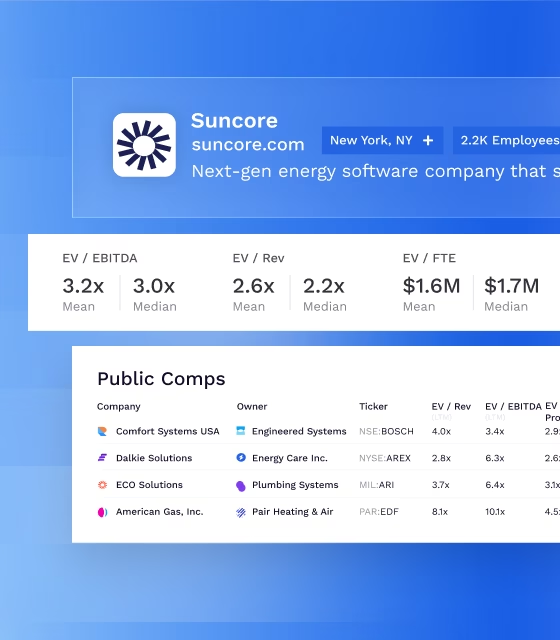

Turn public comps into actionable insights

Benchmark against public peers and integrate with private data

Support narratives with real-time comps

Filter by market behavior

See the Full Picture of Your Market

Trusted by over 1,000 global customers, 35 of the top 40 firms, and 9 of the top 10 management consulting firms

PUBLIC COMPS

Comprehensive Market Analysis in a Snap

Leverage the most comprehensive data to find the comps you need, without the noise.

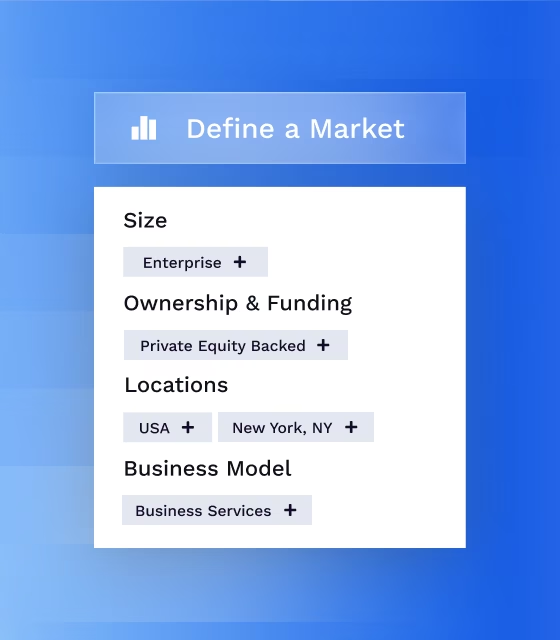

Define

Define your market using keywords, industry classifications, or your lists.

Discover

Discover subsidiaries and divisions similar to your companies of interest.

Analyze

Analyze complete, accurate financial metrics and valuation multiples for public companies in your industries.

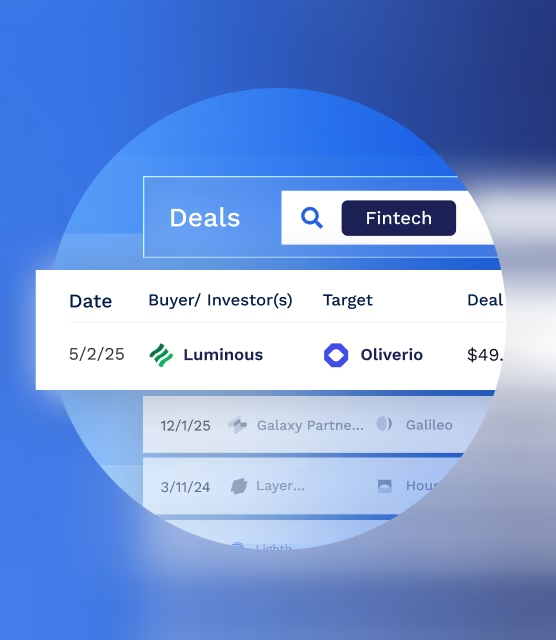

Target

Target opportunities in your market with precision and win more deals.

WHY CUSTOMERS LOVE GRATA

Customer Testimonials

The fact that Grata was already focusing on AI before it become a widespread trend shows they're ahead of the curve, positioning AI as the future.

For me, the biggest thing is definitely due diligence and industry comps. That's really what I go to Grata for, because the way you're able to put in a company and then break down its size and more makes it so much easier for me. From there, I can decide if it's a fit or not.

Schedule a demo to get started

From family-owned roofing companies to PE-backed enterprise software and everything in-between, Grata has the data you need.

Frequently asked questions

How do I benchmark a private company against public comparables?

Analysts look at industry alignment, business model fit, scale, revenue signals, and market activity to identify comparable publicly traded companies.

Why is finding the right public comps so difficult?

Private company data is typically limited and fragmented, making it difficult to match business models, segments, or scale to similar public companies based solely on SIC/NAICS codes.

How do I know if a public comp is actually relevant to my target?

Relevance comes from detailed operational attributes — such as how the company sells, who it serves, and how it grows — not just the industry label.

What’s the fastest way to build a list of comparable public companies?

Teams usually combine sector research, peer analysis, and screening tools to filter public companies that match a target’s characteristics.

How does Grata make it easier to find public comps for private companies?

Grata connects private-company attributes to comparable public peers, giving analysts automated match suggestions based on real business similarities.

Can Grata help me evaluate how closely a private company aligns to a public peer group?

Yes. Grata highlights shared behaviors, industry patterns, and operational traits so analysts can quickly judge comp quality and fit.

How do deal teams use Grata Public Comps during diligence?

Teams benchmark growth, positioning, business models, and market context to understand valuation ranges and competitive landscapes faster.

Can public comp groups be saved or reused for future deals?

Analysts can save and export comp sets, refine them over time, and apply them across multiple deals or theses to maintain consistency.

What improves when analysts use Grata for public comp research?

Faster comp building, stronger benchmarking accuracy, clearer rationale for comps used in investment memos, and a more repeatable diligence process.

Check Out Additional Public Comps Resources Here

.png)

How to Value a Private Company: VC & Growth Comps

How to Value a Private Company: M&A Comps