Mergers and acquisitions (M&A) are complex transactions that require a blend of strategic planning, financial acumen, and operational precision. From target identification to post-merger integration, each phase plays a critical role in determining the deal’s success.

This comprehensive guide breaks down the essential steps in the M&A process and explores the challenges and best practices for navigating each phase. Whether you’re preparing for a merger, structuring a deal, or aligning operations post-closing, understanding the intricacies of the M&A process is key to executing successful transactions.

Read on to discover the strategies that companies can leverage to unlock value and achieve sustainable growth through M&A.

Key Takeaways

- The mergers and acquisitions (M&A) process is a multi-stage sequence that begins with strategic planning and culminates in post-merger integration, each phase critical to deal success.

- Successful M&A transactions start with clear strategic objectives, thorough market research, and assembling a cross-functional team to guide target identification and assessment.

- Firms must apply defined criteria and leverage industry networks to identify and evaluate potential acquisition or merger targets that fit long-term goals.

- Cultural misalignment, integration complexities, regulatory hurdles, valuation disagreements, and talent retention issues can impede deal success and must be proactively managed.

- A disciplined process supported by cross-functional expertise, transparent communication, and retention strategies enhances the likelihood of achieving M&A objectives.

Key Steps in the M&A Process

The M&A process involves several critical stages:

Preparing for the M&A process: This stage involves strategic planning, where companies assess their objectives, resources, and market conditions. The goal is to determine if an acquisition or merger aligns with their long-term goals and to identify potential risks and opportunities.

Identifying potential targets: Once a company decides to pursue an M&A, the next step is to identify suitable acquisition or merger targets. This involves researching and vetting companies that fit strategic objectives, whether it’s expanding market share, gaining new technologies, or entering new markets.

Conducting due diligence: Due diligence is a comprehensive review of the target company's financials, legal matters, and operational performance. This stage ensures that the buyer has a full understanding of the target's value and potential risks before committing to the transaction.

Negotiating and structuring the deal: After completing due diligence, negotiations take place to determine the deal’s terms and structure. This includes the purchase price, the method of payment, and how the new ownership will be managed.

Financing the acquisition: Securing the appropriate financing is crucial for any acquisition. Companies may use various sources of capital, such as loans, equity, or a combination of both, to fund the transaction.

Obtaining regulatory approvals: Many M&A transactions require approval from regulatory bodies to ensure compliance with antitrust laws and other regulations. This stage ensures that the deal meets legal requirements and avoids any potential roadblocks.

Closing the deal: Once all approvals are secured and final negotiations are completed, the transaction is officially closed. This involves signing the necessary legal documents and transferring ownership of the target company.

Post-merger integration: The final and often most challenging stage involves integrating the operations, cultures, and systems of the merging companies. Effective integration is essential for realizing the strategic and financial benefits of the deal.

We cover each of these phases in more depth in the sections below.

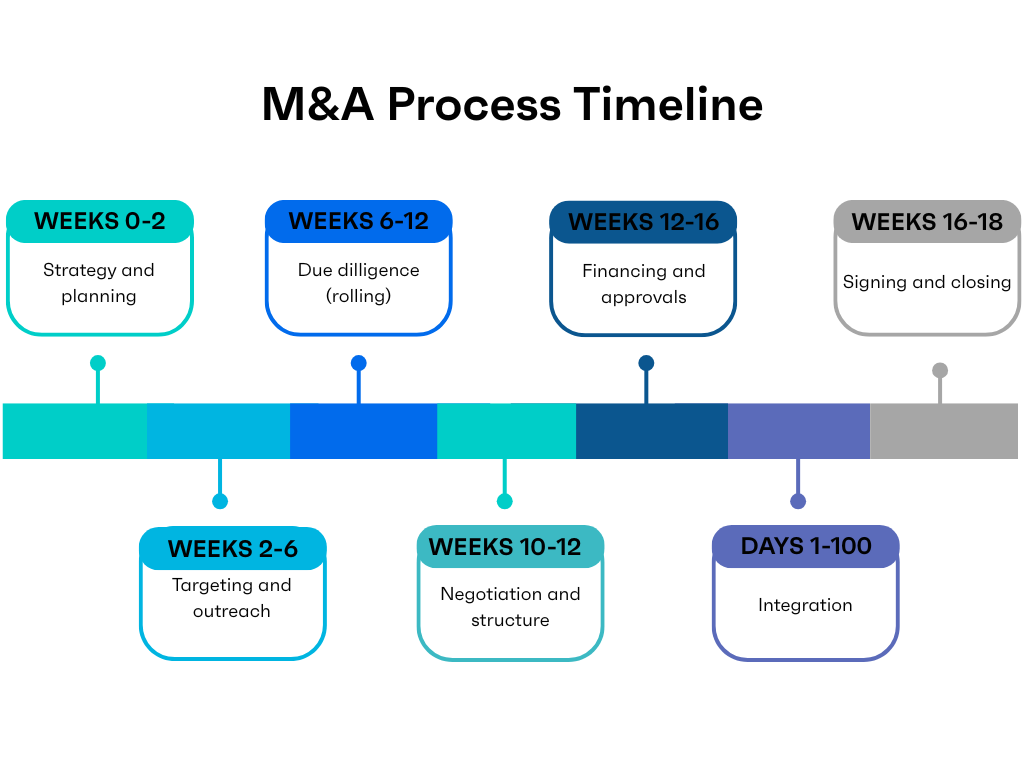

M&A Process Timeline

Generally, the typical M&A process timeline looks something like this:

- Week 0-2: Strategy & planning

- Weeks 2-6: Targeting & outreach

- Weeks 6-12: Due diligence (rolling)

- Weeks 10-14: Negotiation & structure

- Weeks 12-16: Financing & approvals

- Weeks 16-18: Signing & close

- Day 1-Day 100: Integration

1. Preparing for the M&A Process

Before embarking on a lengthy M&A journey, firms need to clarify their strategic vision and goals for future transactions. Key steps include:

- Defining strategic objectives: Companies need to determine how an acquisition or merger would align with their strategic objectives. Whether it's expanding market share, entering a new geographic region, acquiring innovative technology, or enhancing operational efficiency, having a defined purpose guides the entire M&A process.

- Assembling a cross-functional team: M&A deals are complex and require expertise from multiple departments. Building a cross-functional team ensures that every aspect of the transaction is covered. This team typically includes executives, financial advisors, legal experts, operations managers, and HR professionals.

- Developing a comprehensive plan: A well-constructed M&A plan outlines the steps and timeline for the deal. This includes identifying potential acquisition targets, determining the financial structure of the transaction, and planning for due diligence. The plan should also account for post-merger integration.

Companies that invest time and effort in the preparation stage are far more likely to navigate the complexities of M&A smoothly and realize the full value of the transaction.

2. Identifying Potential Targets

Successfully executing a merger or acquisition deal hinges on pinpointing companies that align with the prospective buyer’s strategic goals. Here are the key steps involved in the process:

- Conducting market research: The first step is to perform in-depth market research. This involves analyzing the industry landscape, identifying emerging trends, and assessing competitors. Companies need to understand which sectors are growing or consolidating and where the best opportunities lie.

- Establishing selection criteria: Once the market is understood, it's time to define clear selection criteria. This may include financial metrics (such as revenue, EBITDA, or profit margins), geographic location, customer base, market position, or growth potential. By setting these parameters, companies can efficiently narrow down a list of potential targets that meet their specific objectives.

- Leveraging industry networks and advisors: Networks of investment bankers, private equity firms, and other advisors can help companies uncover opportunities that may not be publicly available. Tools like investor discovery complement these relationships by showing which sponsors and strategics are actively investing in a space, helping deal teams prioritize targets, anticipate competition, and time outreach more effectively. These intermediaries often have valuable connections with potential sellers and can facilitate introductions or help initiate negotiations.

Through meticulous market research, well-defined selection criteria, and expert guidance, companies can ensure they are focusing on acquisition targets that offer the best potential for long-term success.

3. Conducting Due Diligence

Thorough due diligence helps ensure that the deal aligns with the buyer’s strategic objectives and identifies any issues that could affect the transaction’s success. There are several different types of due diligence:

- Financial due diligence focuses on evaluating the target’s financial health. It involves reviewing financial statements, tax records, revenue streams, profitability, cash flow, and debt obligations. The goal is to verify the accuracy of financial reports, uncover hidden liabilities, and assess the company’s long-term financial sustainability.

- Legal due diligence examines the legal framework of the target company. This includes reviewing contracts, intellectual property, litigation history, regulatory compliance, and any outstanding legal disputes. The goal is to avoid future liabilities that could undermine the deal’s value.

- Operational due diligence assesses the target’s internal operations, including its supply chain, production processes, technology, and human resources. The goal is to identify inefficiencies, redundancies, or areas where the acquiring company could add value post-merger.

- Cultural due diligence often plays a less visible but equally important role in the success of an acquisition. It involves assessing the target company’s corporate culture, values, and employee engagement. Understanding the cultural dynamics ensures that the two companies can work together effectively and align on long-term goals.

Due diligence is essential for uncovering potential risks and ensuring the target company fits with the buyer’s strategic and cultural objectives.

4. Negotiating and Structuring the Deal

Negotiating and structuring the deal is one of the most pivotal stages in the M&A process. It involves determining a fair valuation for the target company and agreeing on favorable terms that protect the interests of both parties. Here’s an overview of the key activities involved:

- Determining valuation: Often a complex process that considers various factors such as financial performance, growth potential, market position, and synergies that the acquisition can create. Valuation methods can include discounted cash flow (DCF) analysis, comparable company analysis, or precedent transactions.

- Negotiating terms: Once the valuation is agreed upon, both parties enter negotiations to determine the specific terms of the deal. This includes discussing payment structures (e.g., cash, stock, or a combination), warranties, indemnifications, non-compete clauses, and other contractual obligations.

- Structuring the transaction: This refers to deciding on the legal and financial framework of the deal. Common structures include asset purchases, stock purchases, or mergers. The structure chosen can have significant tax, legal, and financial implications for both parties. For example, a stock purchase might allow the buyer to acquire the company’s liabilities along with its assets, while an asset purchase might allow for the exclusion of certain unwanted liabilities.

The negotiation process must balance the buyer’s need to secure favorable terms and minimize risk with the seller’s desire to maximize value. When done well, it lays the foundation for a transaction that benefits both sides.

5. Financing the Acquisition

The next step is to secure the necessary funding for the transaction, which involves:

- Evaluating financing options: Before proceeding with the acquisition, buyers must assess various financing options available to them. These options typically include debt financing (loans or bonds), equity financing (issuing stock), or a combination of both.

- Engaging with lenders and investors: Once financing options are evaluated, buyers need to engage with potential lenders or investors. This can involve banks, private equity firms, venture capitalists, or other financial institutions. Engaging early with these stakeholders allows the buyer to gauge the terms and conditions of financing, including interest rates, repayment schedules, and equity stakes.

- Negotiating financing terms: After identifying suitable financing partners, the buyer enters negotiations to finalize the terms of the financing. Key factors to negotiate include interest rates, repayment schedules, collateral, and covenants (conditions imposed by lenders to ensure loan repayment).

Proper financing not only facilitates the acquisition, but also plays a critical role in supporting the growth and operational needs of the combined entity.

6. Obtaining Regulatory Approvals

Regulatory approvals ensure the deal complies with legal and antitrust regulations in the jurisdictions involved. Failure to secure these approvals can delay or even derail a transaction. Here are the key steps involved in obtaining regulatory clearances:

- Identifying applicable regulations: The first step is to identify the specific regulations and governing bodies relevant to the deal. These can vary depending on the size, industry, and geographic scope of the companies involved. Common regulatory considerations include antitrust laws, industry-specific regulations, and national security restrictions.

- Preparing and submitting filings: Once the regulatory requirements are identified, the next step is to prepare and submit the necessary filings to the relevant authorities. This process typically involves compiling detailed documentation about the transaction, including financials, market impact analyses, and strategic goals.

- Addressing regulatory concerns: Regulatory bodies often conduct a thorough review of the proposed deal to assess its potential impact on competition, consumers, and the broader market. During this review, authorities may raise concerns, such as the risk of creating monopolies, reducing competition, or violating industry-specific rules. Companies must be prepared to address these concerns.

Navigating the regulatory landscape can be a complex and time-consuming process, but it is essential to ensuring a compliant and successful M&A transaction. Failure to obtain the necessary approvals can lead to legal challenges, fines, or the complete termination of the deal.

7. Closing the Deal

Closing the deal marks the final stage of the M&A process. It requires precision and coordination to ensure that all legal, financial, and operational elements are in place. Here’s an overview of the steps involved in closing the deal:

- Finalizing legal documentation: The first step in closing is to finalize the legal documentation. This includes drafting and signing the purchase agreement, any amendments to existing contracts, and legal documents required for transferring assets and ownership. Any last-minute changes or conditions must be carefully documented to avoid future disputes.

- Transferring ownership: Once the legal documentation is completed, the formal transfer of ownership takes place. This can involve transferring shares, assets, or other forms of ownership, depending on how the deal is structured. Financial settlements, such as payments for the acquisition, are also processed at this stage.

- Announcing the transaction: After the deal is finalized, it’s time to announce the transaction to key stakeholders, including employees, customers, investors, and the public. A well-thought-out communication plan is essential to ensure that the message is delivered clearly and consistently. This announcement typically outlines the rationale behind the deal, the benefits for both companies, and any significant changes that stakeholders can expect.

Careful attention to detail and coordination between legal, financial, and operational teams are essential to ensure a smooth closing. Additionally, an effective communication plan ensures that the transaction is well-received by stakeholders, helping pave the way for a successful post-merger integration.

8. Post-Merger Integration

The true value of an M&A transaction is realized through successful post-merger integration. This stage is critical for achieving the strategic objectives of the deal and ensuring that the combined entity operates smoothly and efficiently. Here’s a look at the key steps involved in post-merger integration:

- Developing an integration plan: First create a comprehensive integration plan that outlines how the two companies will merge their operations, systems, and processes. This plan should cover all key areas, including finance, HR, IT, and marketing, and set clear timelines and goals for each function. A dedicated integration team, typically composed of leaders from both companies, is responsible for overseeing the execution of this plan.

- Managing cultural integration: Cultural integration is one of the most challenging aspects of post-merger integration. Merging two distinct corporate cultures can lead to conflicts and misunderstandings if not handled carefully. It’s essential to identify the core values of each company and determine how best to align them. Open communication, leadership alignment, and employee engagement are crucial for ensuring a smooth cultural integration.

- Implementing synergy initiatives: This involves streamlining operations, eliminating redundancies, and leveraging combined resources to improve efficiency and profitability. This could include consolidating departments, optimizing supply chains, or integrating technology platforms.

Effective post-merger integration is essential for maximizing the value of the transaction. It ensures a smooth transition for employees, customers, and stakeholders, ultimately fulfilling the strategic goals of the M&A deal.

Common Challenges in the M&A Process

Even the most carefully planned M&A deals can face significant challenges. Identifying and addressing these issues early in the process is essential for increasing the chances of a successful transaction.

Below are some of the most common challenges in the M&A process, along with strategies for overcoming them.

Cultural clashes

One of the most significant challenges in M&A is the potential for cultural misalignment between the two organizations. Differences in leadership styles, values, and workplace environments can lead to conflicts, disengagement, and even loss of key talent.

To address this, companies should prioritize cultural due diligence alongside financial and operational evaluations. Open communication, leadership alignment, and early engagement with employees from both organizations are crucial for fostering a unified culture.

Integration complexities

Integrating two companies’ systems, processes, and operations is often more complex than anticipated. Differences in technology platforms, supply chains, and customer bases can create inefficiencies and delays.

To mitigate these issues, it’s essential to develop a detailed integration plan with clear timelines and objectives. Appointing a dedicated integration team can help manage this process and ensure that all departments are aligned in their efforts.

Conduct a thorough operational assessment during due diligence to identify potential integration challenges. This allows for early planning and resource allocation to ensure a smoother integration.

Regulatory hurdles

Regulatory challenges can delay or even block an M&A deal. Antitrust concerns, industry-specific regulations, and international legal requirements may complicate the process, particularly for cross-border transactions.

Companies must engage legal and regulatory experts early in the process to identify potential hurdles and ensure compliance with all applicable laws. Work closely with regulatory authorities from the outset and maintain transparency throughout the process to address concerns proactively and avoid unnecessary delays.

Valuation challenges

Determining a fair valuation for the target company is often a contentious issue in M&A transactions. Overpaying for a target can lead to disappointing returns, while undervaluing a company may result in the deal falling through. Conducting thorough financial due diligence and employing multiple valuation methods—such as discounted cash flow (DCF), comparables, and precedent transactions—can help arrive at a fair and justifiable valuation.

Talent retention

The uncertainty that accompanies mergers and acquisitions can lead to anxiety among employees, increasing the risk of talent loss. Key talent leaving the organization during or after the transaction can disrupt operations and undermine the success of the deal.

To address this, companies must communicate openly with employees, offer retention bonuses or other incentives, and actively manage change to ensure employee engagement and loyalty. Identify critical personnel early in the process and create retention plans to keep them onboard during the transition period.

Best Practices for a Successful M&A Deal

Implementing best practices throughout the M&A process is essential for ensuring a successful outcome. Below are key practices that can increase the likelihood of a smooth and effective transaction:

Developing a clear strategic vision: A well-defined strategic vision helps guide the entire M&A process. Identify how the acquisition or merger aligns with long-term business objectives and what specific goals — such as market expansion, cost efficiencies, or technological advancement — it aims to achieve.

Assembling a strong team: M&A transactions are complex, requiring expertise from multiple disciplines. Build a cross-functional team that includes leaders from finance, legal, operations, human resources, and IT. Engaging external advisors, such as investment bankers or legal consultants, can also provide valuable insights and expertise.

Conducting thorough due diligence: Due diligence is essential for uncovering risks and validating the value of the target company. Assess financials, legal obligations, operational strengths, and cultural alignment to ensure a comprehensive understanding of the business.

Fostering open communication: Transparent communication with internal and external stakeholders throughout the M&A process is crucial. Develop a communication plan to keep employees, customers, investors, and regulators informed about the transaction’s progress and impact.

Prioritizing talent retention: Retaining key employees is vital for operational continuity and realizing the strategic goals of the deal. Identify critical talent early in the process and offer retention incentives to maintain engagement and loyalty.

By following these best practices, companies can enhance their ability to navigate the complexities of M&A transactions.

M&A Process Checklist

This checklist provides a practical guide to organizing and executing key activities across the entire M&A process, from pre-deal preparation to post-merger integration. Use it as a framework, but adapt it as needed to align with the specific circumstances of each transaction.

1. Pre-Deal Preparation

- Define strategic objectives and acquisition criteria.

- Conduct market research to identify potential targets.

- Assemble a cross-functional M&A team (finance, legal, HR, IT, etc.).

- Engage external advisors (investment bankers, legal counsel, consultants).

- Develop a detailed M&A project plan with timelines and milestones.

2. Target Identification and Initial Contact

- Establish selection criteria (financials, market position, cultural fit).

- Create a list of potential targets.

- Conduct preliminary evaluations of shortlisted companies.

- Reach out to potential targets and initiate discussions.

- Sign a non-disclosure agreement (NDA) to protect sensitive information.

3. Due Diligence

- Conduct financial due diligence (analyze financial statements, cash flow, liabilities).

- Perform legal due diligence (review contracts, compliance, and intellectual property).

- Assess operational efficiency and technology compatibility.

- Evaluate cultural fit and alignment with corporate values.

- Document findings and share them with key stakeholders.

4. Deal Negotiation and Structuring

- Agree on a fair valuation based on financial analysis.

- Negotiate deal terms, including payment structure and contingencies.

- Choose the appropriate deal structure (asset purchase, stock purchase, or merger).

- Draft the purchase agreement and review with legal counsel.

- Set timelines for regulatory approvals and closing.

5. Securing Financing

- Evaluate financing options (debt, equity, or combination).

- Engage with lenders and investors to secure funding.

- Negotiate favorable financing terms (interest rates, covenants).

- Finalize financing agreements and prepare for disbursement.

6. Regulatory Approvals and Compliance

- Identify applicable regulations and governing bodies.

- Prepare and submit regulatory filings.

- Address concerns raised by regulatory authorities.

- Obtain the required approvals before proceeding with the transaction.

7. Closing the Deal

- Finalize all legal documents and contracts.

- Transfer ownership (assets, shares, intellectual property).

- Process financial settlements and payments.

- Announce the deal to stakeholders, customers, and the public.

8. Post-Merger Integration

- Develop an integration plan with clear goals and timelines.

- Align leadership and management teams.

- Consolidate operations, systems, and processes.

- Manage cultural integration to foster employee engagement.

- Monitor synergy initiatives and track progress toward objectives.

This checklist offers a comprehensive framework, but every M&A transaction is unique. Companies should adapt these steps to their specific circumstances, deal structures, and industry requirements to achieve the best possible outcomes.

FAQs

What is a typical M&A process timeline?

A typical M&A process takes 6 to 12 months, though timing varies by deal size, complexity, and regulatory requirements. Early strategy and target identification may take several months, while diligence, negotiation, and closing often compress into a shorter, more intensive window. Post-merger integration can extend well beyond closing and is critical to realizing value.

What are the 5 stages of mergers and acquisitions?

While frameworks vary, the M&A process is commonly described in five stages:

- Strategy and planning – defining objectives, deal rationale, and criteria

- Target identification and screening – sourcing and evaluating potential targets

- Due diligence and valuation – validating financials, operations, risks, and fit

- Negotiation and deal execution – structuring, financing, approvals, and closing

- Post-merger integration – combining operations, teams, and systems to capture synergies

How do you plan an M&A?

Effective M&A planning starts with a clear strategic thesis—why the deal matters and how it supports long-term goals. From there, buyers define target criteria, assemble internal and external advisors, outline a diligence plan, and align stakeholders early. Strong planning also includes preparing an integration roadmap before signing, not after, to ensure value creation begins on day one.

What are the steps in M&A?

The key steps in the M&A process include preparing for the deal, identifying potential targets, conducting due diligence, negotiating and structuring the deal, securing financing, obtaining regulatory approvals, closing the transaction, and post-merger integration.

What is the M&A cycle?

The M&A cycle refers to the complete sequence of activities from the initial strategic planning phase to post-merger integration. It encompasses preparation, target identification, due diligence, negotiation, financing, regulatory clearance, deal closure, and integration.

What is the M&A structured process?

The structured M&A process is a systematic approach that ensures every phase of the transaction is executed efficiently. It includes defining objectives, conducting due diligence, negotiating terms, finalizing legal agreements, and managing integration to achieve strategic goals.

What does M&A mean?

M&A stands for mergers and acquisitions, a process where companies merge into a single entity or one company acquires another to expand operations, enter new markets, or gain strategic advantages.

What is an M&A framework?

An M&A framework provides a structured methodology for planning, evaluating, and executing mergers and acquisitions. It outlines key stages, stakeholder roles, evaluation metrics, and integration strategies to ensure a cohesive and effective process.

What is the M&A structure?

The M&A structure refers to the legal and financial framework used to complete a transaction, such as stock purchases, asset purchases, or mergers. It impacts tax obligations, liability transfer, and the integration approach post-acquisition.